THE PRICE OF ART: BEYOND THE MILLION-DOLLAR HYPE

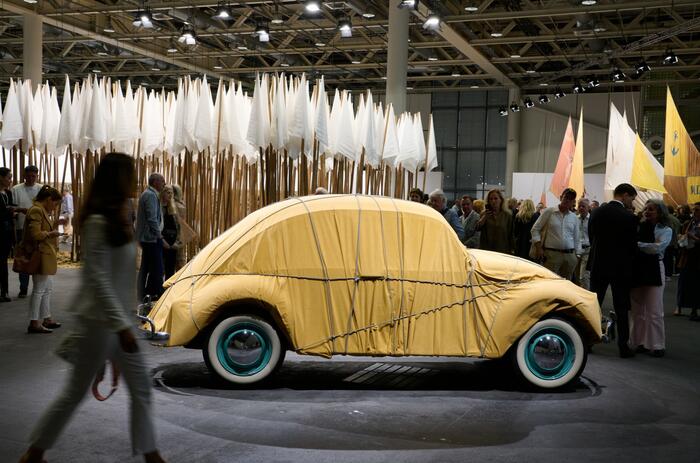

The art market stands out as a unique and enigmatic sector, notoriously difficult to measure and largely unregulated. Yet, it never fails to captivate the media, drawing attention with its dazzling multimillion-dollar sales and the alluring glamour of art collecting.

In 2023, the global art market was valued at approximately $65 billion. Although this seems like a substantial figure, it remains relatively small compared to other luxury sectors. For instance, LVMH's revenue for the same period was $94 billion. Media coverage often highlights sensational multimillion-dollar sales and remarkable stories of artworks bought cheaply and later sold for fortunes. This type of coverage fosters the perception that art buying is an exclusive activity for the ultra-wealthy and that every artwork will inevitably appreciate significantly over time. Nothing could be further from the truth. A useful analogy, drawing a parallel with the fashion and luxury industry, is that just as haute couture is a niche reserved for a select few, many people can afford a Gucci bag and even more can afford a Dior lipstick.

A study presented by Sotheby’s and ArtTactic1 revealed that between 2018 and 2022, artworks selling at auction for over $1 million accounted for 74% of total sales by value, despite representing only 4% of the number of lots sold. This indicates that while few people buy and sell artworks priced over $1 million, many engage in art transactions at lower price levels. This trend is also reflected in the fact that 50% of the art market's value is represented by just 20 artists whose works fetch very high prices2.

Further supporting this, art economist Magnus Resch, in his book "How to Collect Art," states that based on his own research3, there are only around 6,000 people worldwide who spend more than $100,000 per year on art.

Data4 from the fine art auction sector in 2023 revealed that the vast majority (93%) of transactions were for prices below $50,000, with 70% of art sold at auction (both online and offline) fetching less than $5,000. Furthermore, data6 from dealers indicates that in 2023, 86% of their transactions were under $50,000, with only 2% exceeding $1 million.

In summary, while the press often highlights art pieces sold for millions, the reality is that such high-value transactions represent a very small fraction of the total volume. This underscores that art is accessible at various price points, catering to many budgets. However, many people still fear overpaying or making poor choices when buying art. The key is understanding buyers' expectations. Those looking to discover the next Basquiat for a few dollars and sell for a profit may face disappointment. However, those who purchase art because they genuinely appreciate it and prefer to embellish their homes with original artworks rather than cheap reproductions will find joy in collecting, and with time some of them will become serious collectors.

There is no definitive good or bad choice when it comes to art; if you like it, then it is a good choice because you will live with it. As for price, the best approach is to start buying only after spending some time visiting galleries, fairs, auctions and browsing online to get a sense of what you like and what you can afford.

While it may be true that the majority of art pieces will not increase in monetary value over time, there are ways to make purchase decisions that maximize the likelihood of artworks holding their value, with a few fortunate pieces even appreciating. To achieve this, consider choosing artists with good gallery representation, a robust exhibition history, inclusion in museums and important collections, and having publications about them. Additionally, buying from reputable dealers or auction houses can provide extra assurance. These entities have a vested interest in maintaining their credibility and are more likely to guarantee the authenticity and provenance of the artworks they sell. Moreover, galleries often work to enhance their artists' careers, further increasing the value and recognition of the artworks they represent.

By following these guidelines, collectors can enjoy their art while making informed decisions that support both their aesthetic and financial goals.

Sources:

1 : The Art Market Beyond $1 Million, 2018–2022, Sotheby’s and Art tactic.

2: Magnus Rechs TBF live from Art Basel in Basel. June 2024, You Tube.

3: Rech, Magnus, ”How to collect art”, Phaidon, 2024, p.12

4: The Art Basel and UBS Art Market report 2024, p. 157

5 : The Art Basel and UBS Art Market report 2024, p. 76