THE START OF THE SEASON

The first half of the year concluded on a low note, and as the art market gets ready to gear up for the last semester, a clearer picture of the challenges faced is emerging.

According to ArtTactic's "Auction Review for the 1st Half of 2024," slow economic growth and geopolitical uncertainty continue to take a toll on the global auction market. Global auction sales by Christie’s, Sotheby’s, and Phillips in the first six months of 2024 were 27.0% lower than during the same period last year. The impact has been particularly felt in the Post-War and Contemporary art segments. Despite the decline in the overall value of auction sales, the number of lots sold has remained relatively stable, suggesting that auction houses have adjusted prices downward to attract buyers. Additionally major galleries and auction houses have laid off staff over the summer and at least two dozen galleries closed in New York in the past year.

Last week the art world had a certain “back to school” feeling with both Seoul and New York holding key fairs. As the third edition of Frieze Seoul opened its doors, South Korea faces a mix of economic and social challenges. While participation in art fairs has surged, sales haven't kept pace, signaling a shift in the art market from a period of rapid expansion to one of maturity. The initial wave of pop-up exhibitions from international galleries without permanent spaces in Korea, a hallmark of past editions, appears to be cooling down this year. The influx of global galleries and art fairs has undoubtedly intensified competition, but it's also sparked growth and innovation among local galleries and artists. For non-Korean galleries, building a presence has increasingly meant adding local artists to their rosters, capitalizing on the unique talent pool. Meanwhile, the Korean government is making waves of its own: alongside its substantial funding for the arts, it has recently relaxed export restrictions on local art created after 1946 and launched the Art Promotion Act. This new legislation is set to standardize the registration of art transactions and implement an annual market survey and a five-year development plan, which should spell positive change for the market.

The VIP preview of Frieze Seoul’s third edition saw tempered expectations, reflecting the country's economic slowdown—and sales followed suit. Good works are selling but with less urgency than in past editions. Yet, the energy remained palpable. This year, Frieze and KIAF weren’t the only players in town; they benefited from the inaugural Seoul Art Week (SAW) and Korea Art Festival (KAF), both running concurrently and drawing in even more visitors and attention. Nearby, the Busan Biennale and the Gwangju biennale added to the buzz, attracting a roster of institutional heavyweights, including MoMA PS1’s Cornelia Butler, UCCA Center for Contemporary Arts' Philip Tinari, and LACMA’s Michael Govan.

Meanwhile, New York was bustling with several art fairs, including The Armory Show (owned by the same organization as Frieze Seoul), Independent 20th Century, and Art on Paper. The Armory Show, now under the new direction of Kyla McMillan, revealed its most noticeable change with a reorganized floor plan, featuring more than 235 galleries this year. The fair boasted strong international representation, but it remains very much a New York event, with a significant presence of U.S.-based galleries. While it might be challenging for the parent organization to host two fairs on opposite sides of the globe at the same time, finding an alternative date is tough due to the packed schedules of potential venues and the desire to align with other cultural events in each host city. Despite these logistical challenges, the target audiences for these fairs are distinct, and larger galleries often have the resources to participate in both events simultaneously.

Several sales were reported at The Armory Show, but the general sentiment was that the market is slow and will likely remain so in the U.S. until at least after the upcoming November elections. Buyers view the political climate, global conflicts, and economic uncertainties as significant factors affecting their purchasing decisions. With so many unknowns, market hesitancy is understandable, and this uncertainty often has a dampening effect on sales. However, the fairs concluded on a more positive note than expected. Some dealers and advisors believe that the worst may be over. While sales were indeed slow and buyers were in no rush, there was still demand, and the competition for sought-after artists, although less intense, continues with shorter waitlists.

At The Armory Show, prices didn’t surpass the $1 million mark. The highest reported sale was Robert Motherwell’s Apse (1980–84), sold by Kasmin Gallery for $825,000 during the VIP preview. Other galleries reported sales mostly in the upper five-figure range. In contrast, Frieze Seoul saw higher price points, with several works reaching seven figures. The standout was Nicolas Party’s Portrait with Curtains (2021), sold by Hauser & Wirth for $2.5 million to a private collector in Asia.

-

"Apse" (1980-84) de Robert Motherwell

-

"Apse" (1980-84) de Robert Motherwell

Situated at the southern tip of Manhattan, the 20th Century Independent fair presents a distinct approach compared to other art fairs. With only 32 exhibitors from 22 countries, this fair is more intimate and curated, focusing exclusively on 20th-century art. Its mission is to challenge and redefine the canon of this period by spotlighting lesser-known or overlooked artists from diverse backgrounds, including various genders, ethnicities, and geographies. The fair's unique atmosphere is reflected not only in its curated selection but also in its pricing structure. Only three works are priced above $1 million, with several in the six-figure range; however, the majority are in the five-figure range, with the $20,000 to $50,000 bracket accounting for 26% of the offerings. This pricing strategy, coupled with the fair’s carefully curated focus, makes the 20th Century Independent a refreshing alternative in the art fair landscape.

-

Karel Appel, Almine Rech, Independent 20th Century, 2024, New York, photography by Leandro Justen, courtesy Independent

-

Karel Appel, Almine Rech, Independent 20th Century, 2024, New York, photography by Leandro Justen, courtesy Independent

-

Independent 20th Century, 2024, New York, photography by Alexa Hoyer, courtesy Independent

In summary, while the art market may not be experiencing record-breaking sales or flashy price tags, there is no indication of a crash either. The situation varies by gallery: international giants continue to hold their ground, while smaller and mid-sized players are navigating more challenging terrain. The market isn't at a standstill, but sales are taking longer, with buyers being more selective about what they purchase and at what price. Several galleries and advisors are optimistic, believing that the market has already hit its lowest point. However, I remain more cautious. This past week marked the start of the season, and I would prefer to take a broader perspective and wait to see how the upcoming October fairs—Frieze in London and Art Basel in Paris—unfold.

May interest you

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

PARAGUAY: AN EXPANDING ART MARKET

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

THE PATH OF MEMORIES – MEXICO AT THE BIENNALE

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

THE ARMORY SHOW’S 30th ANNIVERSARY EDITION

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

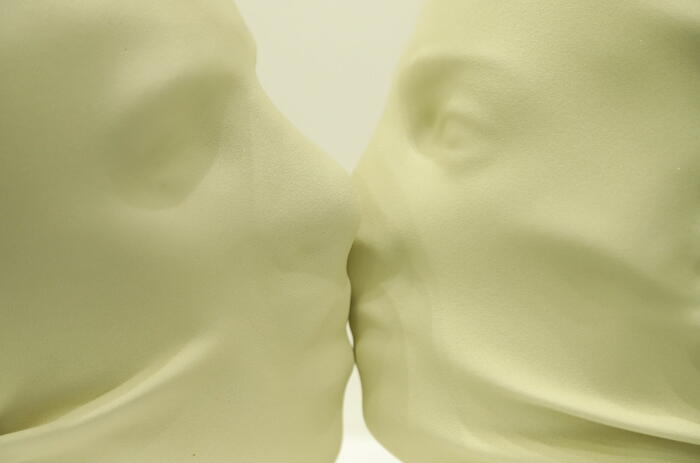

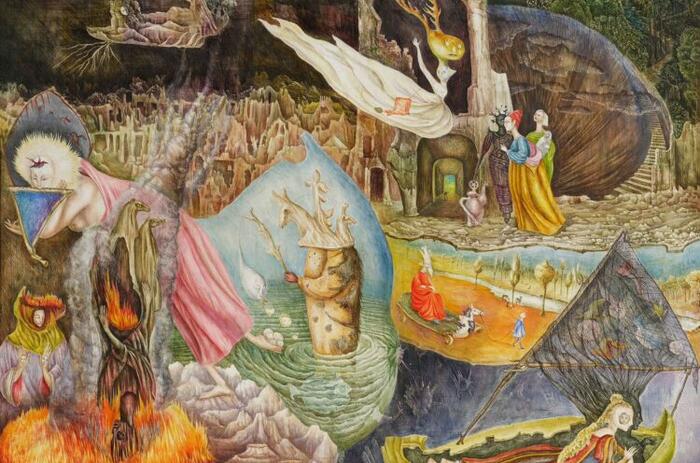

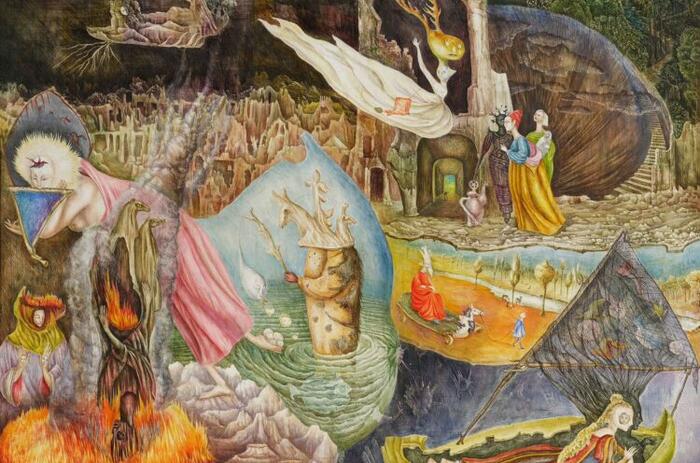

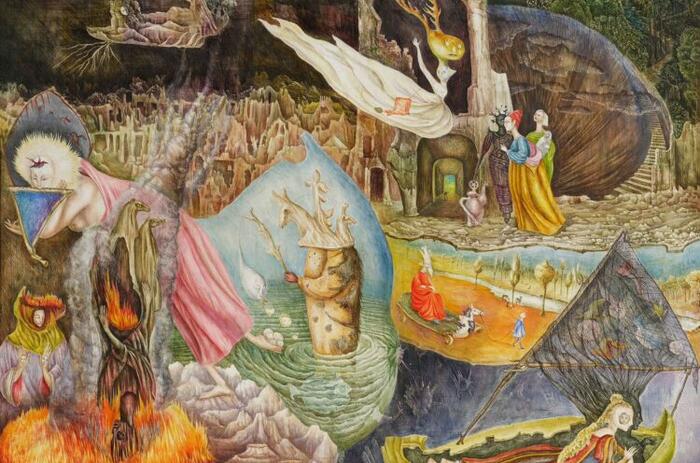

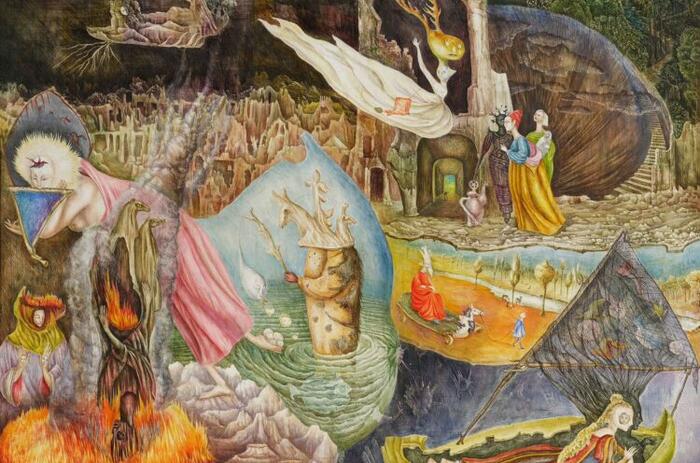

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

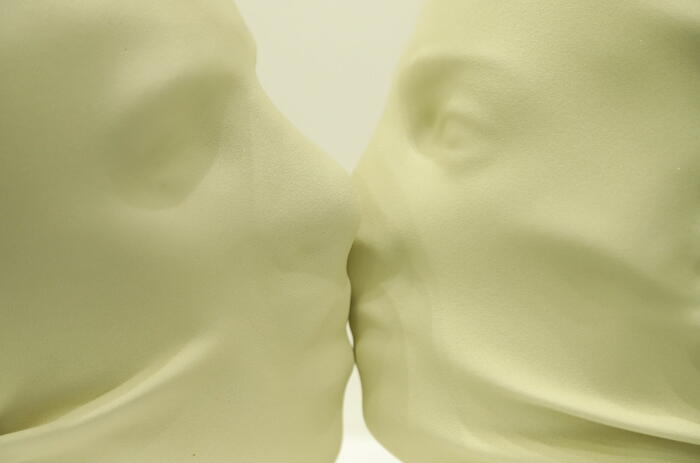

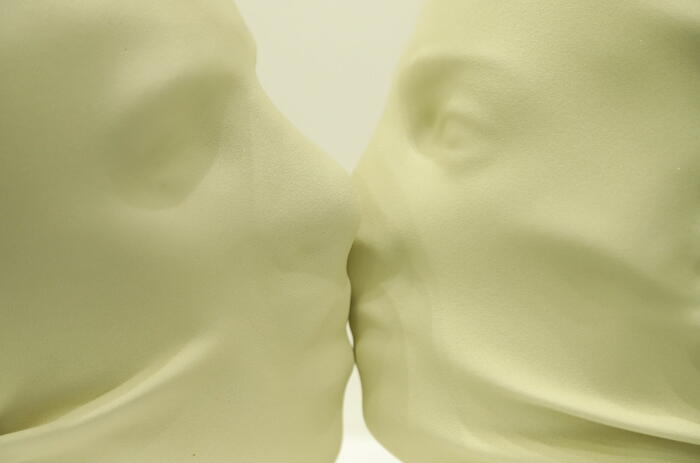

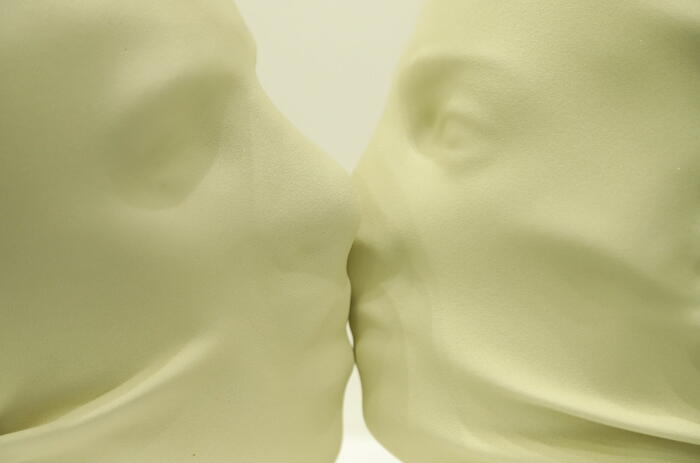

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

THE UNFINISHED STORIES OF LILIANA PORTER

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

A GUIDE FOR PRACTICING DISOBEDIENCE

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

MORE THAN TWO HUNDRED ARTISTS SELECTED FOR THE BROOKLYN ARTISTS EXHIBITION

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

MARÍA SANCHO ARROYO'S NEW BOOK ON HOW TO NAVIGATE THE ART MARKET

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

PARAGUAY: AN EXPANDING ART MARKET

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

THE PATH OF MEMORIES – MEXICO AT THE BIENNALE

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

THE ARMORY SHOW’S 30th ANNIVERSARY EDITION

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

THE UNFINISHED STORIES OF LILIANA PORTER

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

A GUIDE FOR PRACTICING DISOBEDIENCE

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

MORE THAN TWO HUNDRED ARTISTS SELECTED FOR THE BROOKLYN ARTISTS EXHIBITION

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

MARÍA SANCHO ARROYO'S NEW BOOK ON HOW TO NAVIGATE THE ART MARKET

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

PARAGUAY: AN EXPANDING ART MARKET

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

THE PATH OF MEMORIES – MEXICO AT THE BIENNALE

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

THE ARMORY SHOW’S 30th ANNIVERSARY EDITION

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

THE UNFINISHED STORIES OF LILIANA PORTER

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

A GUIDE FOR PRACTICING DISOBEDIENCE

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

MORE THAN TWO HUNDRED ARTISTS SELECTED FOR THE BROOKLYN ARTISTS EXHIBITION

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

MARÍA SANCHO ARROYO'S NEW BOOK ON HOW TO NAVIGATE THE ART MARKET

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

PARAGUAY: AN EXPANDING ART MARKET

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

THE PATH OF MEMORIES – MEXICO AT THE BIENNALE

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

THE ARMORY SHOW’S 30th ANNIVERSARY EDITION

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

THE UNFINISHED STORIES OF LILIANA PORTER

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

A GUIDE FOR PRACTICING DISOBEDIENCE

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

MORE THAN TWO HUNDRED ARTISTS SELECTED FOR THE BROOKLYN ARTISTS EXHIBITION

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

MARÍA SANCHO ARROYO'S NEW BOOK ON HOW TO NAVIGATE THE ART MARKET

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

ARTEBA 2024: THE PULSE OF THE ART MARKET IN ARGENTINA

On Wednesday, August 28, the 33rd edition of arteba, the first art fair founded in Latin America and the most significant in Argentina, began. This year's event features over 400 artists represented by 65 galleries from 16 cities.

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

PARAGUAY: AN EXPANDING ART MARKET

Paraguay is rarely mentioned when discussing the global art market, but this might change in the coming years due to its growing activity in the contemporary art sector. This activity is primarily driven by local galleries, which, aware of the cultural isolation the country has experienced for many years, are actively promoting local collecting and seeking to promote their artists through fairs and participation in events like the current Pinta Sud|ASU.

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

THE PATH OF MEMORIES – MEXICO AT THE BIENNALE

The Mexico Pavilion at the Venice Biennale 2024 proposes an immersive experience that invites the viewer to reflect on the act of migrating and its impact on identity and sense of belonging. As we marched away, we were always coming back is Erick Meyenberg's project curated by Tania Ragasol. It includes elements created in Mexico, Italy and Albania.

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

THE ARMORY SHOW’S 30th ANNIVERSARY EDITION

The Armory Show is taking place from September 6th to 8th. The fair’s 30th edition features over 235 galleries from 35 countries, showcasing artist projects in the Platform section, as well as highlights from sections Galleries, Focus, Solo and Presents, alongside presentation details for the Gramercy International Prize. Now part of the Frieze network, the Armory Show presents a revitalized program that offers a comprehensive view of the contemporary art world.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

THE UNFINISHED STORIES OF LILIANA PORTER

Liliana Porter (Buenos Aires, Argentina, 1941) has a long history shared with Espacio Minimo. The Madrid gallery pampers every move and celebrates the extensive relationship with the Argentinean artist, always offering her the possibility of receiving her work and witnessing its evolution. For the opening of the space's season, the landing is called Otros cuentos inconclusos, a new proposal that deals with representation and two dimensional axes —space and time— that bear witness to many of the questions raised about human relations.

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

A GUIDE FOR PRACTICING DISOBEDIENCE

Disobedience Archive is a video archive project in constant transformation, linking artistic practices and political action. At the Venice Biennale exhibition, it takes the form of The Zoentrope, a pre-cinematographic machine that gives life to a space that generates new perspectives.

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

MORE THAN TWO HUNDRED ARTISTS SELECTED FOR THE BROOKLYN ARTISTS EXHIBITION

The Brooklyn Museum announced the selection of more than two hundred artists for The Brooklyn Artists Exhibition, which will open on the occasion of the Museum’s 200th anniversary. This extensive group show highlights the remarkable creativity and diversity of Brooklyn’s artistic communities. Reflecting on a rich history of fostering creativity and championing artists of all backgrounds, the Museum’s bicentennial is an opportunity to honor the borough’s artistic heritage while looking towards the future.

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.

MARÍA SANCHO ARROYO'S NEW BOOK ON HOW TO NAVIGATE THE ART MARKET

¿Inversión o pasión? Una guía para navegar por el mercado del arte (Investment or passion? A guide to navigating the art market) is the new book by María Sancho-Arroyo, where the author delves into the world of art collecting.