ART MARKET 2024: A YEAR FULL OF CHALLENGES

As 2024 draws to a close, it’s time to assess the state-of-the-art market over the past year. After the post-pandemic boom of 2021 and 2022, the art market suffered a marked slowdown in 2023, which has continued through 2024. According to auction data, the market has accumulated a total decline of 51% since 2022.

Despite these challenges, the mid-season fall auctions demonstrated encouraging resilience, likely due to a recalibration of prices that aligned more closely with buyer expectations. The November sales also delivered solid results, with standout performances for exceptional works.

Most notably, René Magritte’s L’empire des lumières (1954) sold at Christie’s for a record-breaking $121.2 million, the only lot to surpass the $100 million mark in 2024. However, masterpieces remained scarce—a recurring issue in slower markets. The art market operates in cycles: without compelling works, buyers hesitate, and sellers are less inclined to consign high-value pieces. Sourcing remains a significant challenge, with sellers motivated primarily by immediate financial need or favorable terms such as strong guarantees. Auction houses, in turn, rely heavily on third-party guarantees to manage risk. In Christie’s year-end report, presented on December 17th (with Sotheby’s results expected in January), auction sales were reported to have dropped 16% compared to 2023. However, private sales surged by 41%, rising from $1.1 billion to $1.5 billion. This reflects a typical trend during slower markets, as both sellers and buyers often favor the discretion and confidentiality of private transactions.

-

René Magritte (1898-1967) L’empire des lumières signed 'Magritte' (lower right); titled and dated '"L'EMPIRE des LUMIÈRES" 1949' (on the reverse). oil on canvas. 19 1/8 x 23 1/8 in. (48.5 x 58.7 cm.) Painted in 1949. Courtesy Christie's

-

René Magritte (1898-1967) L’empire des lumières signed 'Magritte' (lower right); titled and dated '"L'EMPIRE des LUMIÈRES" 1949' (on the reverse). oil on canvas. 19 1/8 x 23 1/8 in. (48.5 x 58.7 cm.) Painted in 1949. Courtesy Christie's

New York Auctions and Electoral Uncertainty

The New York November sales mirrored the broader uncertainties of the period, partly influenced by the election season. While the auctions took place after the results were announced, consignments had to be finalized weeks earlier, during a time of political and economic instability. This, coupled with ongoing geopolitical conflicts, resulted in sales that were adequate but far from exceptional. Still, as I noted in a previous article, the market appears to have reached its low point, setting the stage for a gradual recovery.In a season lacking headline-grabbing masterpieces, Sotheby’s drew attention with Maurizio Cattelan’s Comedian—the infamous banana duct-taped to a wall. While it sparked public interest, Christie’s delivered more substantial results with Magritte’s record-breaking sale, reinforcing the importance of blue-chip art in driving high-profile auctions.

-

Lot 10, Maurizio Cattelan, 'Comedian', $6.2m. Photo credit: Sotheby’s

-

Lot 10, Maurizio Cattelan, 'Comedian', $6.2m. Photo credit: Sotheby’s

Changes in Market Trends

This year marked a notable pivot toward historical artists, as the market shifted focus away from the volatility of emerging talent. The speculative frenzy surrounding “wet paint” seen in 2021 and 2022 has largely faded, though interest in promising new artists remains.

In the gallery sector, results were mixed. At Miami’s art fairs, from Art Basel to smaller events like Untitled and Pinta, most galleries described sales as “okay.” This often indicates that galleries covered expenses and made modest profits but fell short of exceptional success. Galleries came to Miami following a year of slower sales and extended payment terms, reflecting a more cautious approach in the market. Art Basel exhibitors adopted a conservative approach, presenting a range of artists and price points to appeal to the broadest pool of buyers. Collectors and advisors generally agreed that galleries brought high-quality works at appealing price points, which supported steady sales. However, clients were more deliberate, taking their time to make decisions rather than rushing to purchase on the first day.

Closures and Layoffs

The ongoing downturn has sent ripples across the art market, resulting in the closure of several galleries—from established names like Marlborough to newer, trendier spaces—and significant staff reductions at major auction houses. These layoffs highlight the tough market conditions, particularly as they span multiple firms. Sotheby’s has faced significant challenges, including substantial layoffs: over 50 positions in the UK, another 100 in New York, and additional cuts across its global offices. While declining sales volumes have contributed to these reductions, the company is also grappling with rising operational costs tied to its new premises in Hong Kong, Paris, and its lease of the Breuer Building in New York.

Compounding these difficulties, Sotheby’s recent fee structure—which imposes non-negotiable seller fees on lots under $500,000—has driven many consignors to competitors offering more favorable terms. In response, Sotheby’s has announced that, starting February 2025, it will return to a fee structure more aligned with its previous model, allowing greater flexibility fees for consignments in lower price brackets. Additionally, the auction house appears to be recalibrating its operations following a $1 billion investment from Abu Dhabi’s sovereign wealth fund. Investments of this scale often come with substantial strategic expectations, adding further complexity to Sotheby’s efforts to navigate a challenging and evolving market.

Paris: A Thriving Cultural Hub

Paris has emerged as a major highlight in 2024, radiating energy and enthusiasm throughout the year. The city hosted a dynamic range of events spanning museums, galleries, and auctions, underscoring its growing prominence as a global art hub.

A standout moment was the success of Art Basel Paris, held in the majestic Grand Palais. This edition of the fair brought together top-tier galleries, prominent collectors, and passionate art enthusiasts, firmly reestablishing Paris as a vital destination on the international art calendar. Art Basel Paris also attracted a significant number of American collectors and saw a growing presence of Asian buyers, exceeding engagement levels seen in Basel or Miami. Moreover, collecting in France remains deeply rooted in tradition, guided by passion rather than speculation. This approach makes the market less vulnerable to volatility and speculative bubbles, further solidifying Paris’s reputation as both a cultural and commercial powerhouse in the art world.

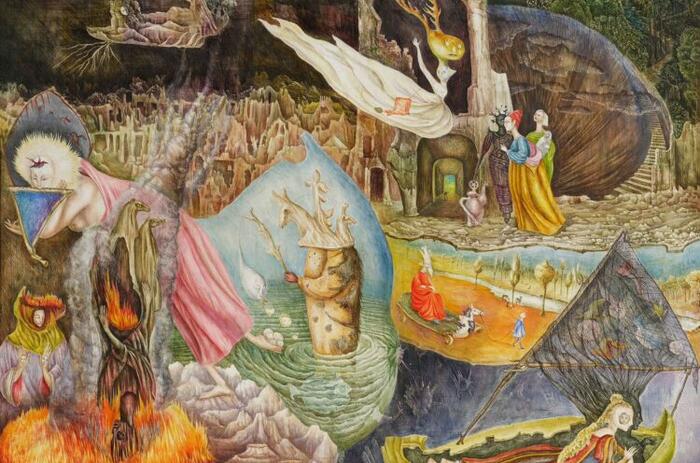

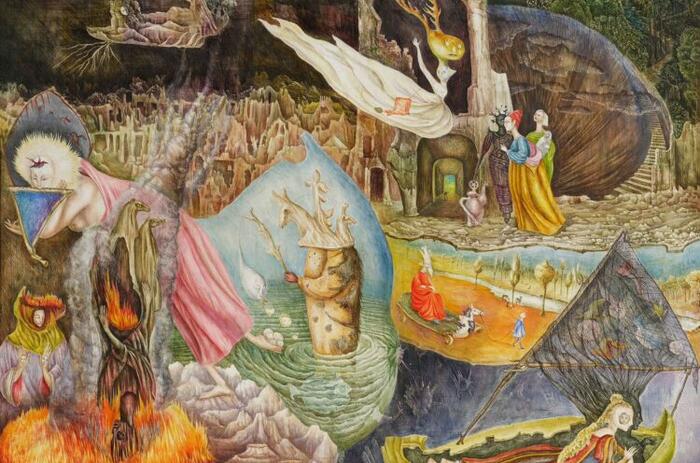

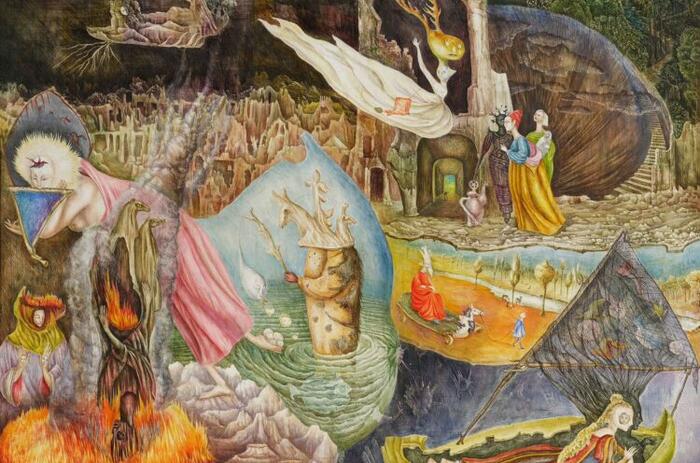

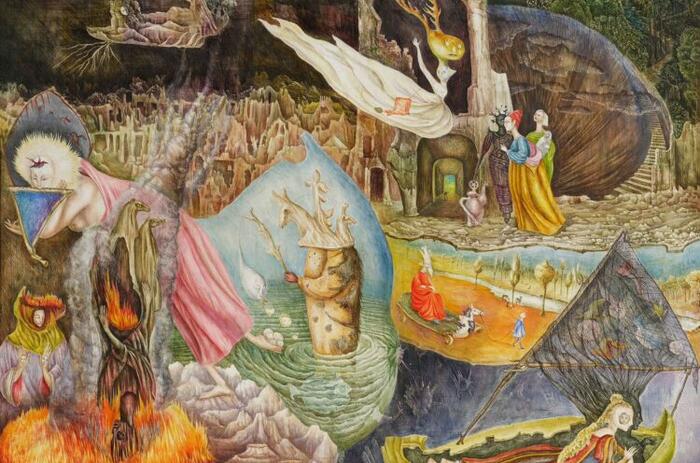

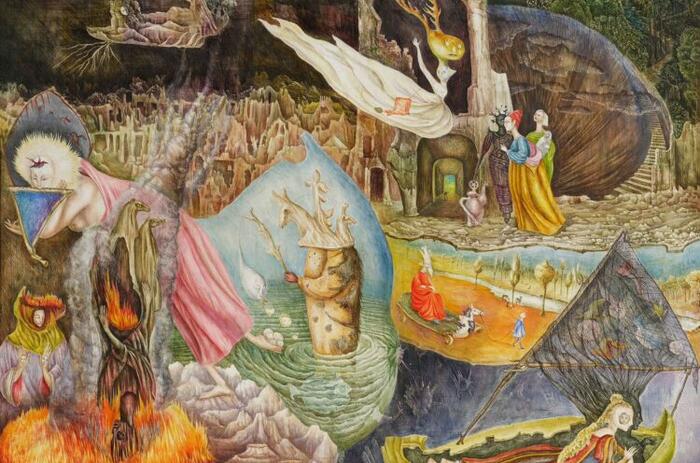

A Bright Spot: Latin-American Art

Despite the challenges of 2024, Latin-American art has been a significant bright spot. The Venice Biennale prominently showcased both historic and emerging Latin-American artists, elevating their global profiles. This increased visibility is expected to positively impact their market valuations and that effect was already reflected on the May auctions with Leonora’s Carrington magnum opus, "Les Distractions de Dagobert," sold at Sotheby's Modern Evening auction for a hammer price of $24,500,000 and in the November sales La Grande Dame (The Cat Woman) reached $11,380,000 solidifying Carrington new standing in the market in an ascending curve, together with other surrealist women artist with Latin-American connections that were brought to prominence in the previous 2022 biennale.

The market for contemporary Latin American artists is on the rise, both at auction and in art fairs, as evidenced during Art Miami week 2024. The prominent presence of Latin American artists across various fairs underscored their growing prominence. At Pinta, the leading fair dedicated to Latin American art, there was a buoyant mood, complemented by a noticeable improvement in the quality of works on offer compared to previous years.

The results were particularly encouraging, with 90% of participating galleries reporting sales and several booths in the Next section achieving sold-out status. Looking ahead, it will be exciting to follow the evolution of these artists’ careers and market trajectories over the next five years, especially as international galleries increasingly begin to champion their work.

-

Leonora Carrington (Lancashire, Inglaterra, 1917 - Ciudad de México, 2011). Las distracciones de Dagoberto, 1945. Temple sobre masonite. 74.9 x 86.7 cm. Colección Eduardo F. Costantini

-

Leonora Carrington (Lancashire, Inglaterra, 1917 - Ciudad de México, 2011). Las distracciones de Dagoberto, 1945. Temple sobre masonite. 74.9 x 86.7 cm. Colección Eduardo F. Costantini

-

Leonora Carrington. La Grande Dame (La mujer gato). Crédito: SOTHEBY’S NY

-

Pinta Miami. Sección NEXT. Sandro Pereira. Desayuno sobre la hierba – Galería The White Lodge.

-

Pinta Miami. Sección NEXT. German Gonzalez. LUOGO Galería

The Outlook for 2025

Looking ahead, the U.S. market—representing nearly 50% of global sales—will be closely watching tax policies and interest rates under the new administration. Historically, the art market performs best in periods of low interest rates, as collectors benefit from greater liquidity and disposable income. One significant concern, however, is the potential reintroduction of tariffs. If former President Trump reinstates heavy tariffs, particularly blanket tariffs on goods from specific countries, the art market could face major disruptions. During Trump’s previous administration, a 25% tariff on goods produced in China—later reduced to 7.5%—impacted both contemporary Chinese art and historical works, such as Ming porcelain. Even pieces held in European collections for centuries were subject to these tariffs if they originated in China. These measures curtailed U.S. gallery participation in Chinese fairs and reduced the number of American art exhibitions in Chinese museums. A return to such policies would undoubtedly reverberate across the art market. Interestingly, since the election, art shippers have reported an uptick in imports to the U.S., possibly as galleries seek to preempt potential tariffs under the new administration.

In conclusion, the art market is undoubtedly influenced by U.S. commercial policies and the state of the U.S. economy. As the largest market globally, shifts in the U.S. resonate across the international art landscape. However, there is cautious optimism within economic circles, suggesting that the market is unlikely to experience further declines unless a significant global crisis disrupts the broader economy. A modest recovery by the summer would not be surprising, marking a potential turning point for the sector.

Related Topics

May interest you

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

GEORGINA VALDEZ AND THE WHITE LODGE: HOW TO GENERATE CONVERSATIONS THROUGH ART

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

ANGELICA ARBELAEZ: PINTA MIAMI AND THE LATIN AMERICAN ARTISTIC NARRATIVE

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

CAF AND PINTA JOIN FORCES TO PROMOTE LATIN AMERICAN ART

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

MIAMI ART WEEK: AN ECOSYSTEM WHERE LOCAL GALLERIES AND COLLECTORS DRIVE GLOBAL IMPACT

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

NOVEMBER AUCTION HIGHLIGHTS: HOW A BANANA STOLE THE SPOTLIGHT

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

ART BASEL IN BASEL 2024: A FAIR FOR EVERY BUDGET?

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

LUIS FERNANDO BENEDIT: ART, SCIENCE, AND ECOLOGY IN DIALOGUE

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

TWO ARCHITECTURE EXHIBITIONS AT MoMA

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

CARIBBEAN ART GOES BEYOND REPRESENTATION

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

PINTA PANAMÁ ARTWEEK: THE FIRST EDITION IN 2025

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

ANA BIDART AND THE FOOTPRINT OF TIME

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

GEORGINA VALDEZ AND THE WHITE LODGE: HOW TO GENERATE CONVERSATIONS THROUGH ART

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

ANGELICA ARBELAEZ: PINTA MIAMI AND THE LATIN AMERICAN ARTISTIC NARRATIVE

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

CAF AND PINTA JOIN FORCES TO PROMOTE LATIN AMERICAN ART

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

MIAMI ART WEEK: AN ECOSYSTEM WHERE LOCAL GALLERIES AND COLLECTORS DRIVE GLOBAL IMPACT

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

NOVEMBER AUCTION HIGHLIGHTS: HOW A BANANA STOLE THE SPOTLIGHT

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

ART BASEL IN BASEL 2024: A FAIR FOR EVERY BUDGET?

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

LUIS FERNANDO BENEDIT: ART, SCIENCE, AND ECOLOGY IN DIALOGUE

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

TWO ARCHITECTURE EXHIBITIONS AT MoMA

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

CARIBBEAN ART GOES BEYOND REPRESENTATION

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

PINTA PANAMÁ ARTWEEK: THE FIRST EDITION IN 2025

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

ANA BIDART AND THE FOOTPRINT OF TIME

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

GEORGINA VALDEZ AND THE WHITE LODGE: HOW TO GENERATE CONVERSATIONS THROUGH ART

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

ANGELICA ARBELAEZ: PINTA MIAMI AND THE LATIN AMERICAN ARTISTIC NARRATIVE

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

CAF AND PINTA JOIN FORCES TO PROMOTE LATIN AMERICAN ART

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

MIAMI ART WEEK: AN ECOSYSTEM WHERE LOCAL GALLERIES AND COLLECTORS DRIVE GLOBAL IMPACT

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

NOVEMBER AUCTION HIGHLIGHTS: HOW A BANANA STOLE THE SPOTLIGHT

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

ART BASEL IN BASEL 2024: A FAIR FOR EVERY BUDGET?

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

LUIS FERNANDO BENEDIT: ART, SCIENCE, AND ECOLOGY IN DIALOGUE

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

TWO ARCHITECTURE EXHIBITIONS AT MoMA

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

CARIBBEAN ART GOES BEYOND REPRESENTATION

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

PINTA PANAMÁ ARTWEEK: THE FIRST EDITION IN 2025

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

ANA BIDART AND THE FOOTPRINT OF TIME

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

GEORGINA VALDEZ AND THE WHITE LODGE: HOW TO GENERATE CONVERSATIONS THROUGH ART

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

ANGELICA ARBELAEZ: PINTA MIAMI AND THE LATIN AMERICAN ARTISTIC NARRATIVE

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

CAF AND PINTA JOIN FORCES TO PROMOTE LATIN AMERICAN ART

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

MIAMI ART WEEK: AN ECOSYSTEM WHERE LOCAL GALLERIES AND COLLECTORS DRIVE GLOBAL IMPACT

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

NOVEMBER AUCTION HIGHLIGHTS: HOW A BANANA STOLE THE SPOTLIGHT

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

ART BASEL IN BASEL 2024: A FAIR FOR EVERY BUDGET?

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

LUIS FERNANDO BENEDIT: ART, SCIENCE, AND ECOLOGY IN DIALOGUE

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

TWO ARCHITECTURE EXHIBITIONS AT MoMA

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

CARIBBEAN ART GOES BEYOND REPRESENTATION

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

PINTA PANAMÁ ARTWEEK: THE FIRST EDITION IN 2025

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

ANA BIDART AND THE FOOTPRINT OF TIME

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

PINTA MIAMI: LATIN AMERICA FROM NORTH TO SOUTH

Pinta Miami celebrated its 2024 edition from December 5th to 8th, 2024 with more than 16,500 visitors, 45 galleries and 14 countries present. The fair at The Hangar, Coconut Grove led to good sales –where over 90% of the galleries reported sales– and enthusiastic overall attendance providing a true exchange between private, public spheres and opportunities for artists and galleries.

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

GEORGINA VALDEZ AND THE WHITE LODGE: HOW TO GENERATE CONVERSATIONS THROUGH ART

Georgina Valdez is the founder and director of the Argentine gallery The White Lodge, with locations in Córdoba and Buenos Aires. The space is part of the NEXT section of Pinta Miami 2024, with works by artists Sandro Pereira and Nushi Muntaabski. In an interview with Arte al Día, the gallerist reflected on the role of art as an engine of transformation and the place of The White Lodge in the contemporary art scene.

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

ANGELICA ARBELAEZ: PINTA MIAMI AND THE LATIN AMERICAN ARTISTIC NARRATIVE

In the upcoming edition of Pinta Miami –from December 5 to 8, 2024– Angelica Arbelaez will be in charge of the RADAR section. In a dialogue with Arte al Día, she reflects on the role of Latin American art in international artistic discourses and how artists from the region contribute to the construction of a new global artistic narrative for a richer and more inclusive world.

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

CAF AND PINTA JOIN FORCES TO PROMOTE LATIN AMERICAN ART

CAF – Development Bank of Latin America and the Caribbean – and Pinta, an international platform for promoting Latin American art through fairs and artistic circuits across the region, have formalized a strategic alliance aimed at strengthening and promoting Latin American and Ibero-American art worldwide. This collaboration will culminate in a prominent Art Week to be held in Panama City in May 2025, a new initiative designed to position regional culture on the global stage.

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

MIAMI ART WEEK: AN ECOSYSTEM WHERE LOCAL GALLERIES AND COLLECTORS DRIVE GLOBAL IMPACT

Miami Art Week has just concluded, providing an excellent opportunity to reflect on Miami's evolution as a growing art center and a prominent player in the art market.

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

NOVEMBER AUCTION HIGHLIGHTS: HOW A BANANA STOLE THE SPOTLIGHT

The November auctions of Modern and Contemporary Art in New York, long considered barometers of the art market’s health, showcased striking contrasts last week, revealing both the enduring power of exceptional art and the market’s appetite for spectacle.

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

LEONORA CARRINGTON ARRIVES AT MALBA AFTER BREAKING RECORDS

Malba announces the eagerly awaited arrival of Leonora Carrington's The Distractions of Dagoberto (1945), one of the most significant works by the celebrated surrealist artist, which was acquired in May by Eduardo F. Costantini at Sotheby's at a record price.

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

ART BASEL IN BASEL 2024: A FAIR FOR EVERY BUDGET?

The Art Basel in Basel fair concluded on June 16th, signaling the near end of the market season before summer. Despite the June London auctions (featuring works from antiquity to contemporary art) this year’s London season is notably diminished.

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

LUIS FERNANDO BENEDIT: ART, SCIENCE, AND ECOLOGY IN DIALOGUE

An engaging panel discussion will examine the groundbreaking work of Argentine artist Luis Fernando Benedit. Organized as part of the exhibition Luis Fernando Benedit: Invisible Labyrinths, this event brings together distinguished scholars and curators to reflect on Benedit’s significant contributions to Conceptualism, cybernetics, and ecological art. The event is scheduled to take place on Saturday, January 18, 2025, at 2:00 PM EST at ISLAA’s Tribeca location.

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

TWO ARCHITECTURE EXHIBITIONS AT MoMA

The Museum of Modern Art (MoMA) is showcasing two exhibitions that explore the evolving relationship between architecture and its social, environmental, and technological contexts. These shows, Down to Earth and The City May Now Scatter, highlight innovative approaches to design and planning.

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

CARIBBEAN ART GOES BEYOND REPRESENTATION

The Pérez Art Museum Miami (PAMM) presented Beyond Representation, an innovative exploration of Caribbean art that challenges traditional boundaries and creates new narratives. This ongoing digital research project and performance series is curated by Iberia Pérez González and hosted by the museum’s Caribbean Cultural Institute (CCI). It features an intergenerational group of artists who use the body and performative practices to critically engage with social, political, and cultural realities in the Caribbean and its diasporas.

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

PINTA PANAMÁ ARTWEEK: THE FIRST EDITION IN 2025

Pinta is launching Panamá Art Week in 2025 –May 21 to 25–, an initiative created to foster the integration of the art scene and strengthen and consolidate best practices within the sector.

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.

ANA BIDART AND THE FOOTPRINT OF TIME

Delfina Foundation presents on April 4 Long Before the Walls, the first European solo exhibition by Uruguayan artist Ana Bidart. The show introduces a constellation of newly commissioned, site-specific installations and interventions at the Delfina house.